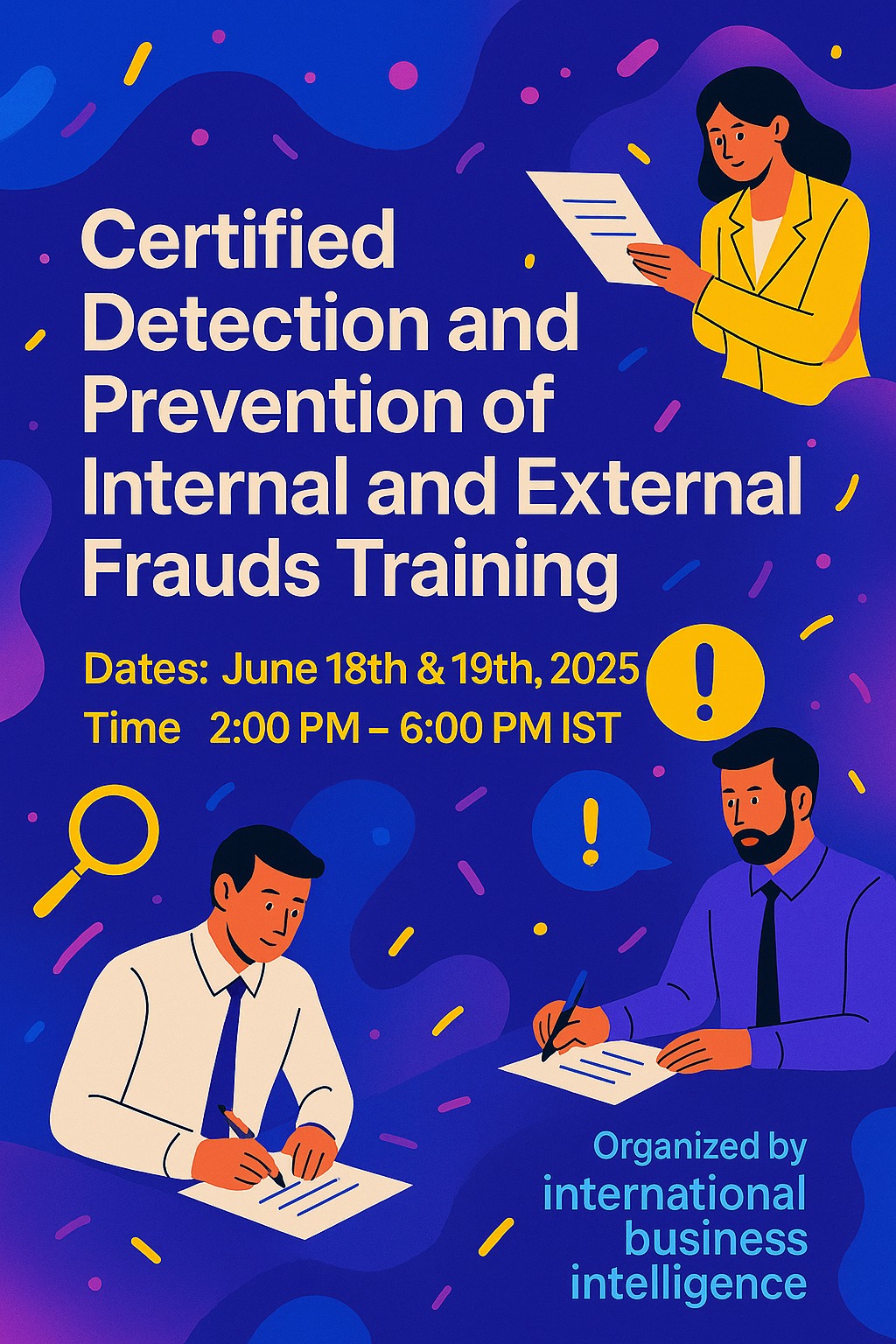

Event details

- June 18th & 19th, 2025 | 2:00 PM – 6:00 PM IST

- Virtual Masterclass

- Microsoft Teams

- +91 98190 20274 / 97735 01525

Fraud risks are evolving faster than ever—internal misconduct, vendor manipulation, financial misreporting, and cybersecurity threats are now daily challenges for modern organizations.

We’re excited to invite you to our Certified Detection and Prevention of Internal and External Frauds Training, a live, two-day virtual event designed to give you the tools and confidence to detect, investigate, and prevent fraud in your organization.

Training Objectives:

- Understand fraud trends and the regulatory landscape in India

- Learn how to identify and respond to red flags in both internal and external fraud

- Conduct effective fraud risk assessments across business functions

- Master forensic investigation techniques and evidence management

- Build a culture of prevention through compliance, training, and ethical leadership

- Use technology and data analytics for smarter fraud detection

What You’ll Learn

- The workshop features 4 power-packed sessions covering:

- Fraud typologies, red flags, and the Fraud Triangle

- Real-world case studies and investigation takeaways

- Detecting fraud in vendor management, P2P cycles, and financial reporting

- Leveraging internal audits, whistleblower mechanisms, and forensic tools

- Interviewing techniques, legal considerations, and documentation best practices

Who Should Attend:

This program is ideal for professionals involved in compliance, risk, governance, and investigations, including:

- Chief Compliance Officers (CCOs)

- Chief Financial Officers (CFOs)

- Internal Auditors / Audit Managers

- Risk & Governance Leaders

- Fraud Investigators / Forensic Accountants

- Finance Controllers / Managers

- Legal & Regulatory Heads

- Procurement / Supply Chain Managers

Why You Should Attend ?

- Learn directly from experts through real case examples and practical frameworks

- Strengthen your internal controls and fraud detection systems

- Discover how to spot and investigate financial manipulation early

- Receive a recognized certification to validate your skills

- Gain immediate, actionable strategies to safeguard your organization

Agenda at a Glance

Day 1

- Understanding the fraud landscape in India

- Internal vs. external fraud typologies

- The Fraud Triangle

- Red flags and real-life case studies

Day 2

- Fraud detection & risk assessment strategies

- Forensic audits & investigation techniques

- Role of AI and data analytics

- Evidence handling and reporting

Trainer:

Sameer Khatu

Certified Fraud Examiner | Behaviour Analyst | Anti-Money Laundering Specialist